What Is the Small Business Deduction?

What Is the Small Business Deduction (SBD) in Canada & How Can Your Business Benefit?

Understanding the Small Business Deduction (SBD)

For Canadian small business owners, corporate tax planning is one of the most effective ways to improve cash flow and support long-term growth. As discussed in our earlier Should You Incorporate Your Business blog post, incorporation can unlock meaningful tax advantages.

One of the most important of these advantages is the Small Business Deduction (SBD). The SBD allows eligible corporations to pay a lower corporate tax rate on a portion of their profits, leaving more money inside the business to reinvest, expand operations, and build long-term value.

How the Small Business Deduction Works

The Small Business Deduction in Canada lowers the corporate income tax rate on the first $500,000 of active business income (ABI) earned by a Canadian‑controlled private corporation (CCPC). This reduced tax rate is designed to help small businesses grow by keeping more after‑tax profits inside the company. This means instead of paying the general corporate tax rate, a CCPC can benefit from a significantly reduced tax rate on qualifying income.

Federal Small Business Tax Rate: 9% (compared to the general corporate tax rate of 15%)

Provincial/Territorial Rates: Vary by province, further reducing overall tax liability

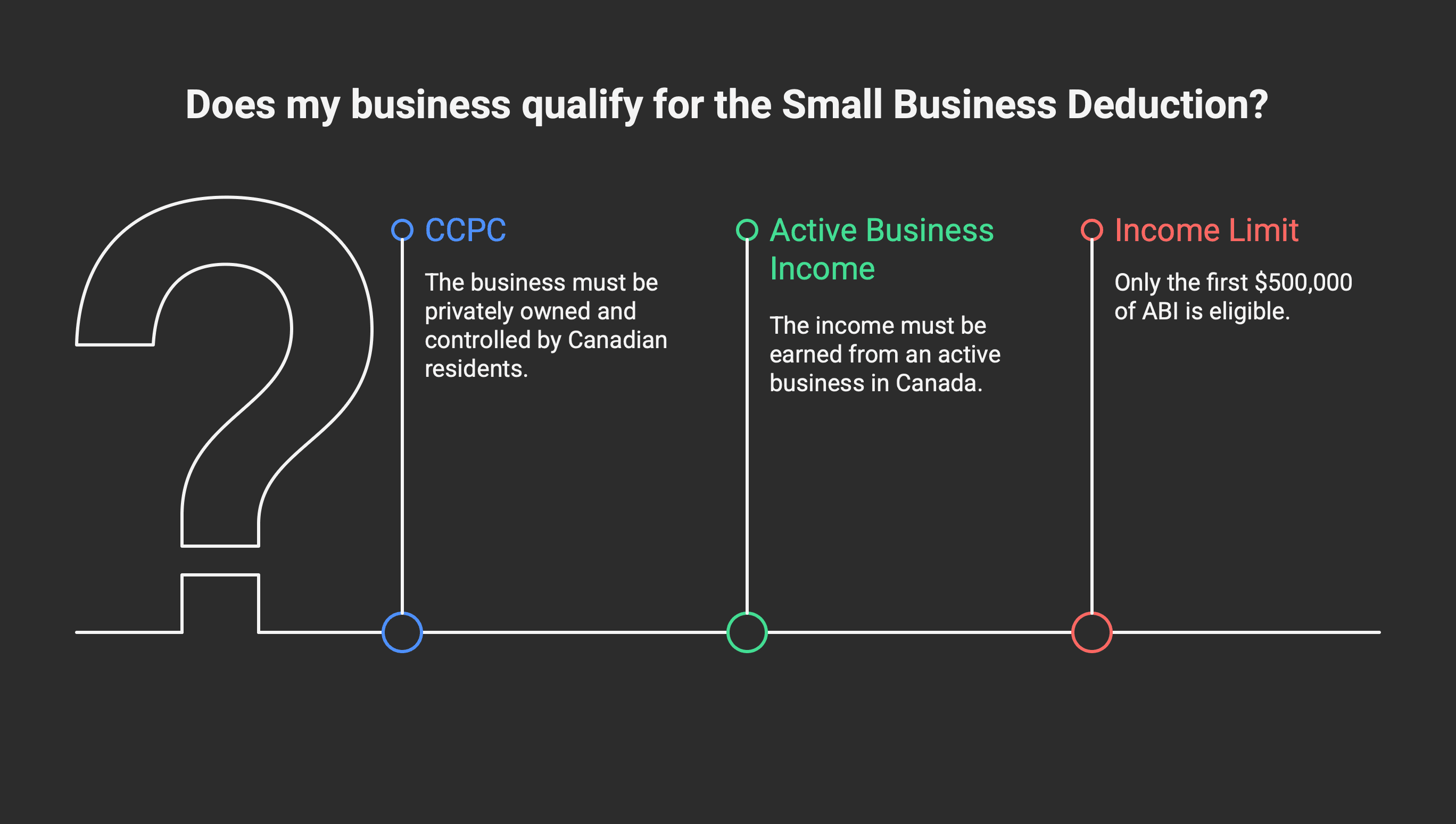

Who Qualifies for the Small Business Deduction?

To benefit from the SBD, a business must meet the following conditions:

Be a Canadian-Controlled Private Corporation (CCPC): The corporation must be privately owned and controlled by Canadian residents.

Earn Active Business Income (ABI): The SBD applies only to income earned from an active business carried on in Canada. Investment income and capital gains do not qualify.

Small Business Limit Applies to the First $500,000 of ABI: A CCPC may earn more than $500,000 of active business income in a year. However, only the first $500,000 is eligible for the Small Business Deduction. Any ABI earned above this threshold is taxed at the general corporate tax rate.

Situations That Can Reduce or Eliminate Access to the SBD

Even if a corporation earns less than $500,000 of ABI, access to the SBD can be reduced or eliminated in the following situations:

Taxable Capital Grind: If a corporation (together with associated corporations) has taxable capital employed in Canada exceeding $10 million, the $500,000 small business limit is gradually reduced. The SBD is fully eliminated once taxable capital reaches $15 million.

Adjusted Aggregate Investment Income (AAII) Grind: If a corporation (and its associated group) earns more than $50,000 of adjusted aggregate investment income, the small business limit is reduced. For every $1 of AAII above $50,000, the SBD limit is reduced by $5. Once AAII reaches $150,000, access to the SBD is fully eliminated.

These grind rules are particularly important for corporations that retain earnings and invest internally or through related entities.

How Your Business Can Benefit from the SBD

The primary purpose of the SBD is to reduce corporate taxes, allowing small businesses to retain more earnings and reinvest them to grow. The key advantage comes when businesses keep profits within the company, ensuring that income is taxed at the lower small business rate and can be used for business expansion, asset purchases, or investment within a related holding company .

By taking advantage of the SBD, small businesses can:

Reduce Tax Liability: A lower tax rate means more retained earnings for growth and reinvestment.

Improve Cash Flow: Keeping more after-tax dollars available for operational costs and expansion.

Enable Business Growth: Savings can be reinvested into hiring, technology, or infrastructure to scale operations.

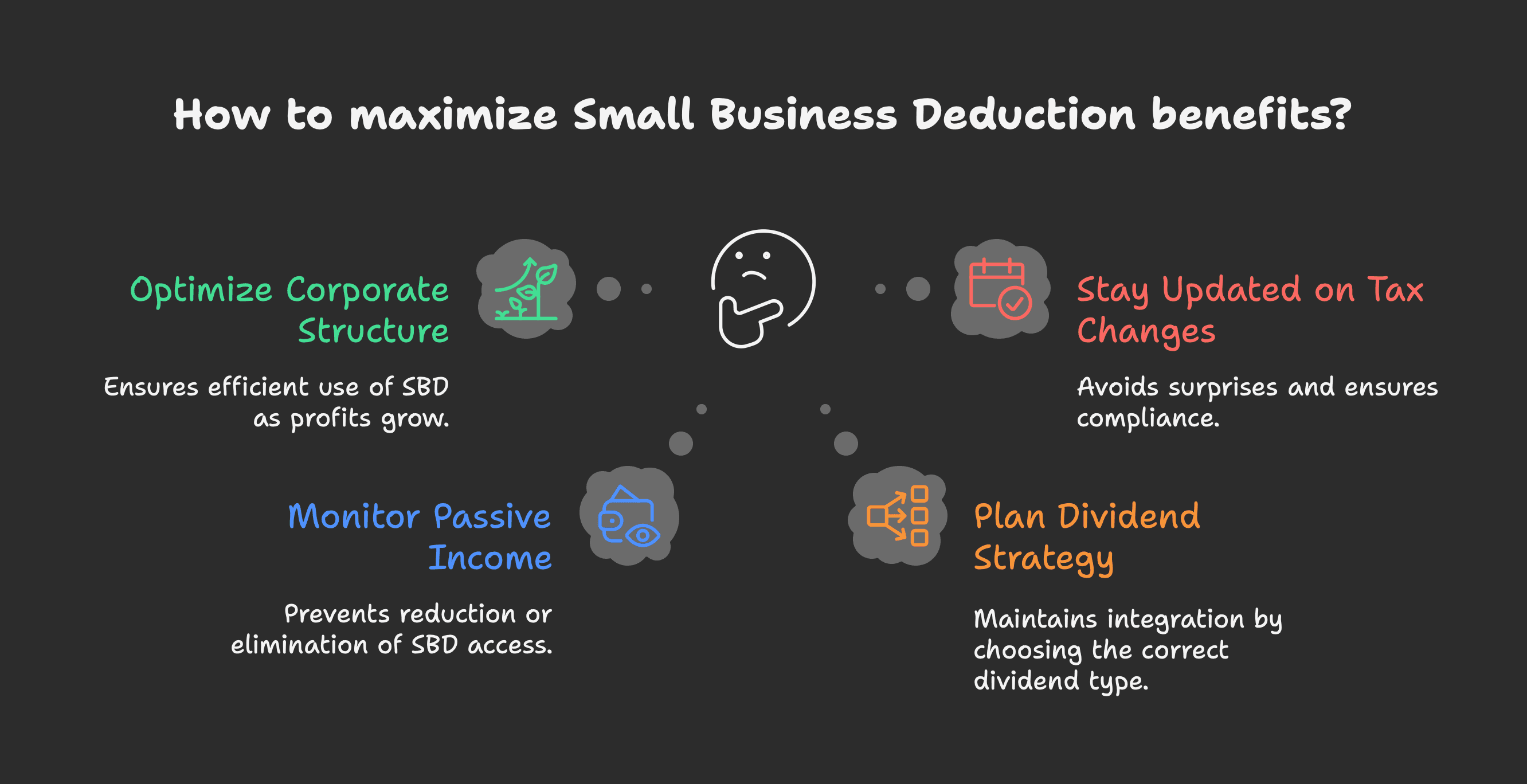

Maximizing the Small Business Deduction Benefits

To ensure your business fully benefits from the SBD, consider the following planning considerations:

Optimize Corporate Structure: Planning ahead as profits grow ensures the SBD is used efficiently.

Monitor Passive Investment Income: Earning over $50,000 in passive income can reduce or eliminate access to the SBD.

Plan Dividend Strategy Carefully: Paying the correct type of dividend (eligible vs. non-eligible) is essential to maintaining integration.

Stay Up-to-Date on Tax Changes: Corporate tax rules evolve, and proactive planning avoids surprises.

Associated Corporations and the Small Business Deduction

Associated corporations share a single $500,000 small business limit. If multiple corporations are associated for tax purposes, the SBD must be allocated among them rather than claimed separately.

This rule prevents artificially multiplying access to the lower small business tax rate. If you operate more than one company, understanding whether your corporations are associated is critical. For a detailed explanation, see our guide on associated corporations ([link to associated corporations blog]).

When the Small Business Deduction Is Most Valuable

The SBD provides the greatest benefit when:

The business is consistently profitable

Owners do not need to withdraw all profits personally

Earnings are reinvested into operations, assets, or growth initiatives

Excess cash is strategically invested through a holding company

If profits are withdrawn every year, the benefit of the SBD is largely neutralized by integration.

Common Small Business Deduction Mistakes to Avoid

Paying non-eligible dividends when GRIP exists, which breaks integration

Triggering the passive income grind unintentionally through corporate investments

Assuming each corporation receives its own $500,000 limit despite association rules

Focusing solely on tax rates instead of cash retention and reinvestment

Frequently Asked Questions

Does earning more than $500,000 eliminate the Small Business Deduction?

No. Only income above the limit is taxed at the general corporate rate.

Is the Small Business Deduction a permanent tax savings?

No. It is primarily a tax deferral when profits are retained in the corporation.

Do holding companies affect access to the SBD?

Indirectly. Passive income and association rules can reduce or eliminate access and must be monitored carefully.

Exceeding the $500,000 Small Business Limit – Is It a Big Deal?

While staying within the $500,000 small business limit provides access to the lower small business tax rate, exceeding this amount is not necessarily a problem—and in many cases, it is simply a sign that the business is growing.

Once a corporation earns income above the small business limit, that excess income is taxed at the general corporate tax rate. Importantly, this higher-taxed income generates General Rate Income Pool (GRIP), which allows the corporation to pay eligible dividends to shareholders.

Understanding GRIP and Eligible Dividends

GRIP is a tracking mechanism that represents corporate income taxed at the general corporate rate. When a corporation has a positive GRIP balance, it may pay eligible dividends, which receive a more favourable dividend tax credit in the hands of shareholders.

Eligible dividends are intentionally designed to preserve tax integration, recognizing that the underlying income has already been taxed at a higher corporate rate.

Why Integration Matters

Under the integration principle of the Canadian tax system, income earned personally should result in approximately the same total tax as income earned through a corporation and then paid out as dividends—assuming dividends are classified correctly.

As long as a corporation pays eligible dividends up to its available GRIP balance, there is no tax penalty for earning income above the $500,000 small business limit.

The Real Advantage: Retaining Earnings

While integration keeps total tax neutral when profits are distributed, the true advantage of the Small Business Deduction is realized when profits are retained inside the corporation:

Income taxed at the small business rate leaves more cash available for growth

Retained earnings can fund expansion, asset purchases, or working capital

Excess funds may be invested through a related holding company ([link to holding company blog])

If all profits are distributed annually, the tax difference between the small business rate and the general corporate rate largely disappears due to integration. The SBD is therefore best viewed as a tax deferral mechanism, not a permanent tax savings.

Simple Example: SBD in Practice

A corporation earns $650,000 of active business income:

The first $500,000 is taxed at the small business rate

The remaining $150,000 is taxed at the general corporate rate, creating GRIP

If profits are retained, the corporation benefits from tax deferral

If profits are distributed, eligible dividends are paid from GRIP, preserving integration

Need Help Navigating the Small Business Deduction?

Understanding and maximizing the Small Business Deduction can significantly impact your business’s bottom line. At ModernAxis, we specialize in tax strategies that help small businesses keep more of their hard-earned money. Contact us today to ensure you’re making the most of your tax advantages.

Alex Ataman, CPA

Founder

Modern Axis CPA

Disclaimer: This blog post is for informational purposes only and does not constitute professional tax advice.