Should You Incorporate Your Business?

Should You Incorporate Your Business in Canada? A Guide to Making the Right Choice

Deciding whether to incorporate your business in Canada is a significant decision that can impact your taxes, liability, brand protection, and ability to raise capital. Many entrepreneurs start as sole proprietors but eventually wonder if incorporation is the right move. This guide explores the advantages and disadvantages of incorporation to help Canadian business owners determine what’s best for their unique situation.

What Does It Mean to Incorporate?

Incorporation is the process of legally structuring your business as a corporation, making it a separate legal entity from its owner(s). In Canada, you can incorporate federally or provincially depending on where you plan to operate and your long-term goals.

Corporations must follow certain legal obligations, including annual filings and the maintenance of proper corporate records. In exchange, the business gains legal protections and significant tax planning opportunities.

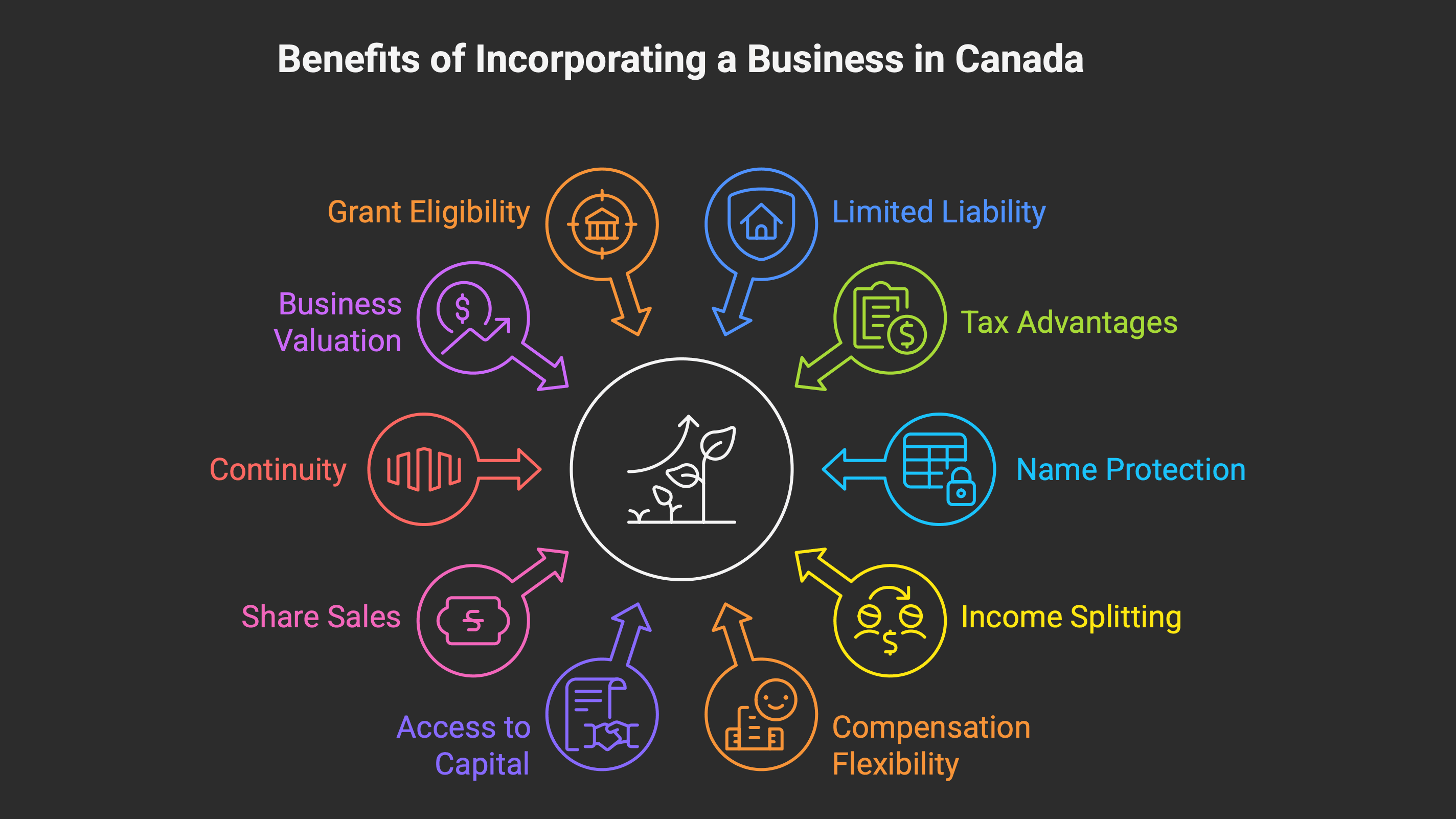

Benefits of Incorporation for Canadian Businesses

1. Limited Liability Protection

One of the biggest advantages of incorporation is that it creates a separate legal entity. This means that your personal assets (such as your home or car) are generally protected from business debts, lawsuits, or financial liabilities arising from your business activities.

2. Tax Advantages for Incorporated Businesses

Corporations in Canada can benefit from the small business deduction (SBD), which lowers the corporate tax rate on the first $500,000 of active business income. This is significantly lower than most personal income tax rates.

However, this tax advantage only applies if you leave some of the profits in the corporation. If you withdraw all earnings as salary or dividends, the tax benefit is often reduced. Strategic income deferral is one of the key reasons business owners choose to incorporate.

[Read our guide on the Small Business Deduction in Canada →]

3. Name Protection

Incorporation provides legal protection for your business name. Once registered, no other corporation can use the same or a similar name in the same jurisdiction. Sole proprietors do not receive this protection even if they register a trade name.

Many accountants overlook this crucial detail—but at ModernAxis, we help clients assess branding risks and protect their intellectual property early on.

4. Income Splitting Opportunities

Incorporated businesses may be able to distribute income to adult family members through dividends, depending on their involvement in the business and applicable TOSI (Tax on Split Income) rules. This can result in significant tax savings when done properly.

5. Flexibility in Compensation

Corporation owners can pay themselves a salary, dividends, or a combination of both. This flexibility allows for tailored tax planning. For instance:

Salaries create RRSP contribution room and CPP contributions.

Dividends can avoid CPP payments entirely, resulting in cash flow savings.

[See our blog post comparing salary vs dividends →]

6. Greater Access to Capital

Incorporation can make it easier to attract investors, apply for business loans, or raise funds. Corporations can issue different classes of shares and bring in new partners or equity investors without restructuring the entire business.

7. Ability to Sell Shares & Use the Lifetime Capital Gains Exemption (LCGE)

Incorporated business owners can eventually sell shares of the company rather than just business assets. If structured properly, you may qualify for the Lifetime Capital Gains Exemption (LCGE)—which can shelter up to $1.25 million in capital gains from tax when selling qualified small business shares.

This is a powerful tool for exit planning, retirement, or passing on your business to the next generation.

8. Continuity and Business Credibility

Unlike a sole proprietorship, a corporation continues to exist even if the owner retires, passes away, or sells the company. This continuity improves the company's professional image, strengthens relationships with lenders, and can open doors with larger clients or government contracts.

9. Enhanced Business Valuation and Succession Planning

Incorporated businesses often receive higher valuations because they are seen as more structured, stable, and scalable. Corporations can also be transitioned to family members or third-party buyers more efficiently, using tools like estate freezes and family trusts.

10. Eligibility for Certain Grants and Programs

Many provincial and federal government grants, business development programs, and innovation incentives (such as SR&ED credits) require the business to be incorporated. If you plan to grow through research or government-backed funding, incorporation is often a prerequisite.

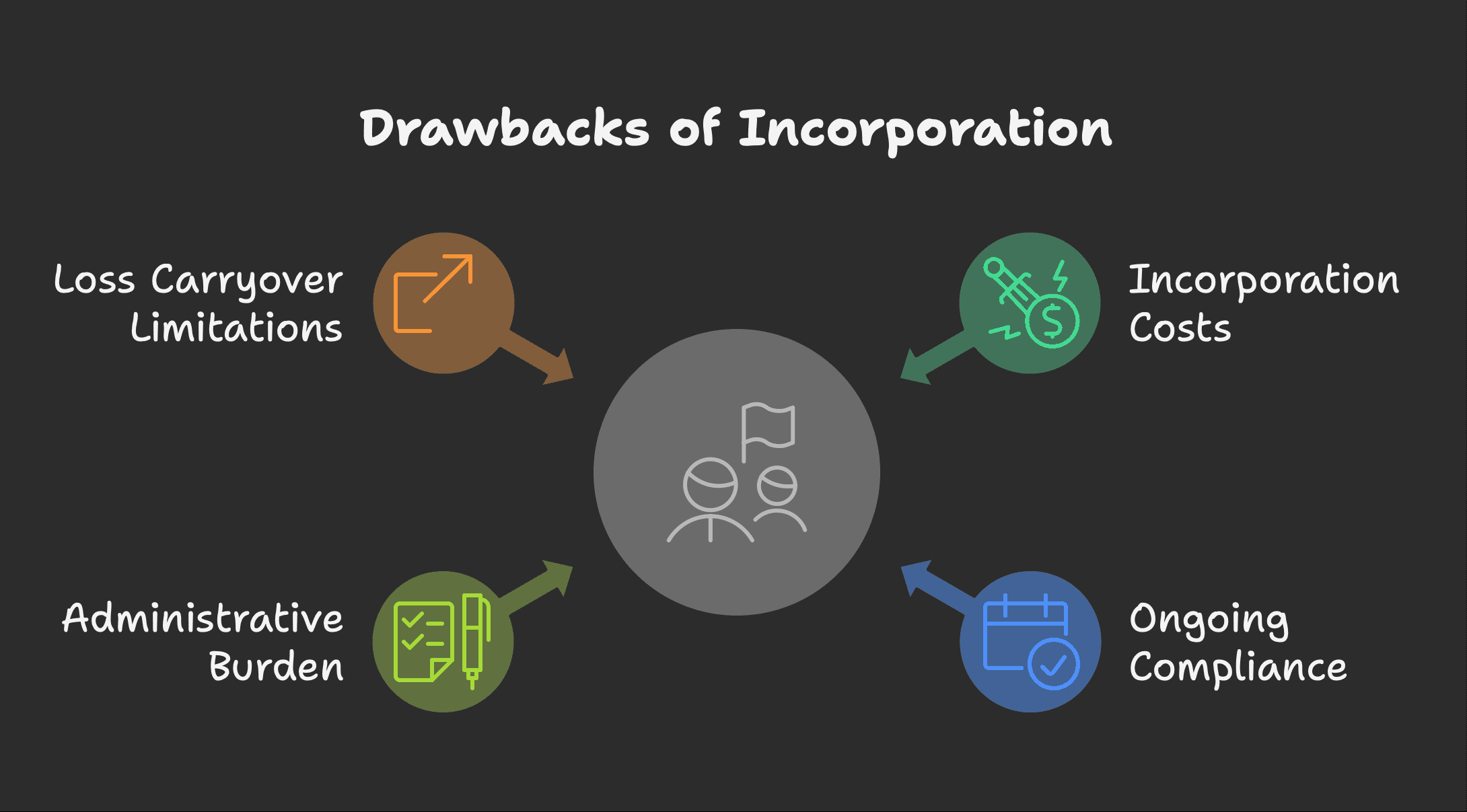

Drawbacks of Incorporation

1. Incorporation Costs and Ongoing Compliance

Starting a corporation involves legal and government fees. There are also ongoing obligations such as:

Annual corporate filings

Preparing corporate tax returns (T2)

Maintaining corporate minute books

These add complexity and administrative costs that sole proprietors can usually avoid.

2. Increased Administrative Burden

Corporations must follow formalities like:

Keeping records of shareholder resolutions

Filing notices of change

Tracking retained earnings

Managing shareholder agreements

If you're not ready to handle these extra responsibilities—or hire a professional to help—you may want to wait until your business has stabilized.

3. Loss Carryover Limitations

Unlike sole proprietorships, where losses can be used to offset other personal income, losses in a corporation are restricted to use within the corporation. This means early-year losses won’t benefit your personal taxes unless you wind up the business and claim allowable business investment losses (ABILs) in certain cases.

When Should You Incorporate Your Business in Canada?

Incorporation may be the right move if:

You’re earning more than you need for personal living and want to defer tax

You want legal protection from business liabilities

You’re building a brand and want to protect the name

You plan to bring on partners, investors, or sell the business eventually

You’re looking to split income with family members or reduce CPP contributions

You want to take advantage of the LCGE in future exit planning

You want to access innovation grants, funding programs, or government contracts

You’re looking for better valuation and succession planning options

Staying a sole proprietor might be better if:

You’re just starting out and revenue is low

You need to keep administrative tasks and costs minimal

You’re operating with minimal liability risk

You anticipate early-stage losses you’d like to apply against other personal income

Common Mistakes When Incorporating

Incorporating too early: Many businesses incorporate before they generate income, resulting in unnecessary complexity and costs.

Ignoring name protection: Failing to search and secure your business name properly can lead to rebranding or legal disputes.

Not planning for compensation strategy: Choosing salary or dividends without understanding tax implications can result in higher taxes or missed opportunities.

Overlooking tax compliance: Missing deadlines or filing incorrectly can result in penalties or loss of small business status.

Skipping shareholder agreements: If you have partners or investors, not having a clear agreement in place can lead to future conflicts.

Not taking advantage of tax planning opportunities: Many owners don’t use tools like LCGE, income splitting, or holding companies because they didn’t get proper advice.

Frequently Asked Questions (FAQ)

Q: Do I need to incorporate if I’m a freelancer or solopreneur?

A: Not necessarily. If your income is modest and you don’t face liability risks, you may be better off as a sole proprietor. Incorporation makes more sense as revenue and complexity grow.

Q: Should I incorporate federally or provincially?

A: Federal incorporation offers broader name protection across Canada, while provincial incorporation is usually faster and more affordable if you only operate in one province. We can help you decide.

Q: How much does it cost to incorporate in Canada?

A: Costs vary, but expect to pay $200–$400 for government fees and $500–$1,500+ for legal/accounting support depending on complexity.

Q: Will incorporation lower my taxes?

A: Possibly. If you don’t need all your income immediately and can leave profits in the company, you may benefit from the small business deduction and income splitting.

Q: Can I still deduct business expenses as a corporation?

A: Yes. You can continue deducting eligible expenses such as home office, travel, equipment, and software, but ensure proper documentation and that the expenses are incurred to earn business income.

Q: What’s the Lifetime Capital Gains Exemption (LCGE)?

A: It’s a tax break that allows you to sell shares of a qualified small business corporation and potentially shelter up to $1.25 million in capital gains from tax. Conditions apply, so plan ahead.

How ModernAxis Can Help

At ModernAxis CPA, we guide entrepreneurs and small business owners through the incorporation decision with a strategic, tax-focused lens. Unlike many firms, we factor in:

Long-term tax planning

Personal and family financial goals

Asset protection

Brand development

Government grant eligibility

Exit strategies and business valuation

We also assist with setting up corporate structures, shareholder agreements, and navigating CRA compliance.

Need help deciding whether to incorporate? Book a consultation with our team and get personalized advice tailored to your business and financial goals.

Alex Ataman, CPA

Founder

Modern Axis CPA