Personal Income Tax in Canada: Guide to Income and Deductions

Conquer Your 2025 Taxes

Personal income tax is how Canada funds public services like healthcare, education, and infrastructure. But filing a personal tax return can still be confusing: what counts as taxable income, what deductions you can claim, and which credits actually reduce your tax bill.

This guide explains the basics of income tax in Canada, highlights key tax deductions and tax credits, and updates the details for the 2025 tax year (income earned in 2025 and filed in 2026). If your situation includes self-employment, rental properties, investments, crypto, or cross-border issues, working with a tax accountant can prevent expensive mistakes.A quick note before you make changes

A quick note before you make changes

Even “simple” steps—like claiming depreciation (CCA) on a business asset, or converting a property into (or out of) a rental—can have long-term tax consequences and reporting requirements. If you’re planning a change, get advice from Modern Axis CPA early.

The hard truth: once a transaction happens, there’s often limited ability to improve the outcome after the fact. A tax accountant can help you plan properly, but you need to be proactive and seek advice well in advance of any major changes.

What is taxable income in Canada?

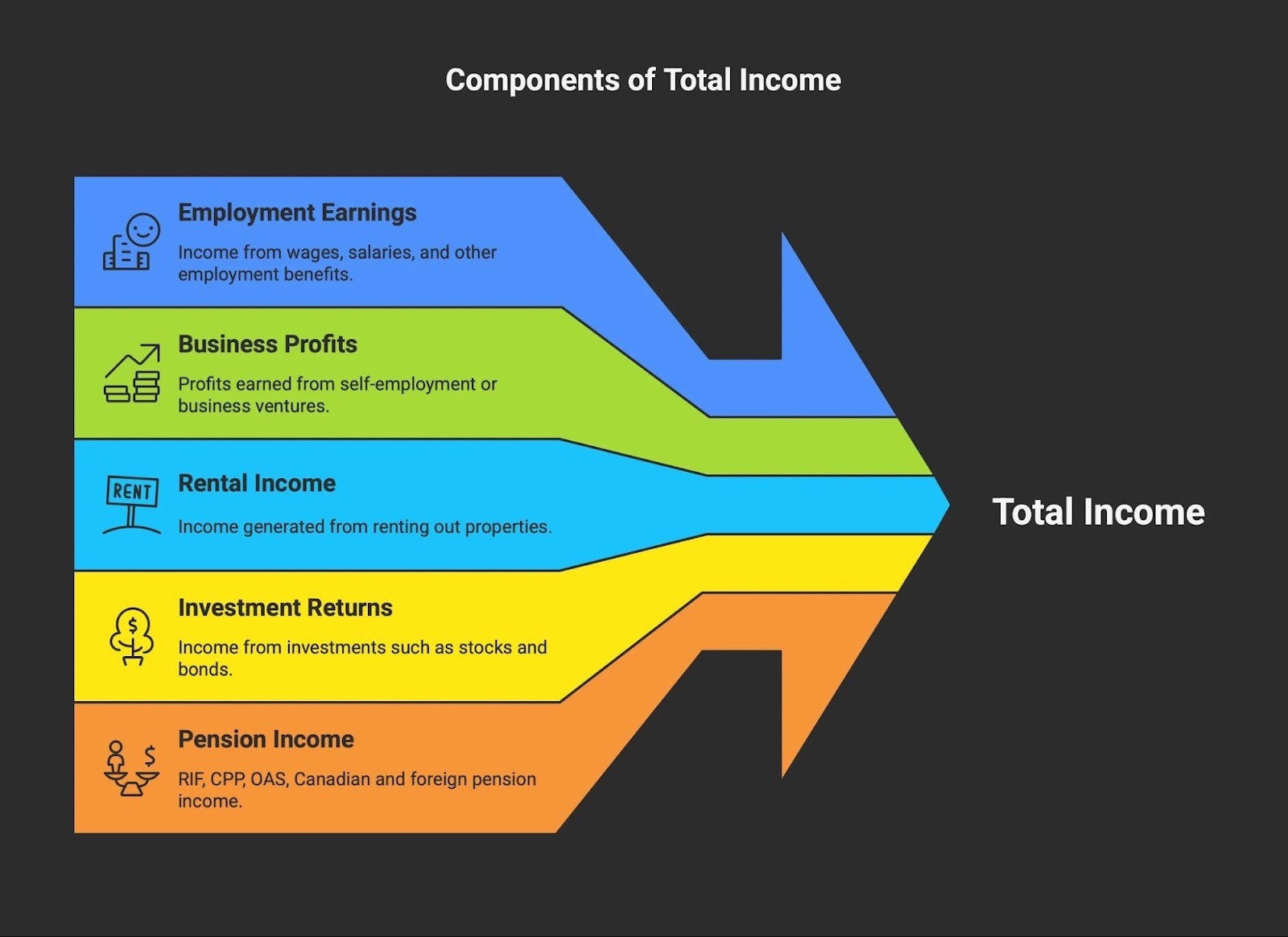

In simple terms, your taxable income is the amount of income you pay tax on after applying deductions. It generally starts with your total income (from all sources) and then subtracts allowable deductions to arrive at taxable income.

Worldwide income (important)

If you are a resident of Canada for tax purposes, Canada generally taxes you on your worldwide income—income earned anywhere in the world. This can include foreign employment income, foreign investment income, foreign rental income, and foreign business income.

A key point many people miss: it usually does not matter whether you bring the money into Canada or leave it abroad. If the income was earned while you were a Canadian tax resident, it is generally reportable in Canada.

You may be able to claim a foreign tax credit to reduce double taxation when tax was paid to another country, but you still typically report the income.

If you are a non-resident of Canada for tax purposes, the rules are different (Canada generally taxes certain Canadian-source income only). Residency is fact-specific, so professional advice matters.

Employment income (T4)

Most employees report income using a T4. This generally includes salary/wages, bonuses/commissions, and some taxable benefits.

In most employee situations, income tax is withheld at source by your employer throughout the year, so you typically shouldn’t face a major unexpected tax bill at filing time.

However, you can still owe tax in common situations—especially if you worked for more than one employer during the year. Each employer may withhold tax as if that job is your only income, which can result in insufficient total withholding once your incomes are combined. Other causes include taxable benefits, investment income, reduced withholding due to TD1 claims, or self-employment/rental income in addition to your job.

Self-employment & business income (T2125)

Contractors, freelancers, and sole proprietors typically report income and expenses on Form T2125.

Big note: self-employment income usually has no tax withheld. Unlike a T4 job, clients don’t deduct income tax from what they pay you. As a result, many self-employed taxpayers are surprised by how much tax they owe at filing time—especially in the first year—because you may need to pay:

Income tax on your net business income, and

CPP contributions for both halves (the “employee” and “employer” portions) on net business income.

Practical takeaway: set aside a percentage of each payment you receive, and consider instalments if you expect to owe tax regularly.

Investment income

Investment income is taxed differently depending on the type, and it’s often reported on multiple CRA slips. Even when you receive a slip, it may not include everything you need (for example, the correct adjusted cost base for capital gains).

Common slips you may see:

T5 (Statement of Investment Income): commonly reports interest and dividends from Canadian sources.

T3 (Statement of Trust Income Allocations and Designations): reports income allocated from trusts/ETFs/REITs (can include interest, eligible/non-eligible dividends, foreign income, capital gains, return of capital, etc.).

T5008 (Statement of Securities Transactions): reports proceeds of disposition for securities. It can be incomplete for tax purposes because it may not reflect your true adjusted cost base (ACB) and may miss adjustments.

Foreign slips/statements: depending on the country/broker, you may receive foreign tax documents or account statements showing foreign income and foreign withholding tax.

How the main types are taxed (high level):

Interest income (e.g., savings accounts, GICs, bonds): generally fully taxable at your marginal tax rate.

Canadian eligible dividends: generally receive a gross-up and dividend tax credit, which often results in a lower effective tax rate than interest (the exact outcome depends on your province and income level).

Foreign dividends/foreign interest: generally taxed like ordinary income in Canada (no Canadian dividend tax credit). Foreign withholding tax may apply; you typically still report the income in Canada and may be able to claim a foreign tax credit if eligible.

Capital gains: generally taxed on the gain (proceeds minus ACB and selling costs), and typically 50% of the gain is included in income.

Practical note: If you trade frequently, hold multiple accounts, or own ETFs/trusts with return of capital and reinvested distributions, tracking ACB properly matters. This is an area where a tax accountant can add real value.

Rental income (T776)

Rental income can be straightforward—or quietly expensive—depending on how the property is used and what you claim. In Canada, rental income is typically reported on Form T776 and is generally your gross rents received minus eligible expenses.

What to report

Rent received from tenants (including short-term platforms)

Other amounts related to renting (e.g., laundry, parking, fees)

Note: security deposits are generally not income when received if they’re refundable; they can become income if kept due to tenant damage/arrears.

Common deductible expenses (if reasonable and incurred to earn rental income)

Mortgage interest (not principal)

Property taxes, insurance

Utilities (if you pay them)

Repairs and maintenance

Advertising, property management fees

Professional fees (accounting/legal) related to the rental

Travel costs can be restricted—this is an area where getting advice matters

Repairs vs capital improvements (big source of mistakes)

Repairs/maintenance (fixing or restoring something) are often deductible.

Capital improvements (betterments/renovations that improve or extend useful life) are generally added to the property’s cost base and deducted over time (not immediately). Getting this wrong can trigger CRA reassessments, denied deductions, interest, and sometimes penalties.

CCA (depreciation): optional and strategic You can choose to claim CCA (depreciation) on certain rental assets/buildings, but it’s optional—and once claimed, it can create future tax costs (like CCA recapture) when you sell. Claiming CCA can also affect principal residence planning if a property is partly personal-use. This is one of those “looks simple, gets complex” decisions.

Short-term rentals (important) Short-term rentals (often defined by stays of less than 90 consecutive days) can be subject to extra rules. If your short-term rental is non-compliant with applicable municipal/provincial rules, income tax deductions can be denied for that activity, which can dramatically increase the tax you pay.

GST/HST/PST can apply Many landlords assume sales tax is never relevant. In reality, short-term accommodationcan be a taxable supply, which may trigger GST/HST obligations (and potentially platform collection rules). Whether you must register depends on the facts (including the small supplier threshold and the type of supply).

Why advice matters Rental tax mistakes can be expensive because they often compound over multiple years (misclassified expenses, missed change-in-use rules, incorrect CCA, improper split of personal vs rental use). If you’re buying a rental, converting a home to a rental, starting short-term rentals, doing renovations, or selling a property with rental history, get advice from Modern Axis CPA early. A small planning step now can prevent a much higher tax bill later.

Pension & retirement income

Common sources include CPP, OAS, employer pensions, and RRIF withdrawals.

Income splitting matters: Depending on the type of pension income and your situation, pension income splitting can reduce a household’s overall tax by shifting eligible pension income to a lower-income spouse/partner. This can be one of the highest-impact planning tools for retirees, but the eligibility rules depend on the type of income (and in some cases, age).

Don’t forget foreign retirement income: If you are a Canadian tax resident, foreign pensions and retirement distributions (for example, U.S. Social Security, foreign employer pensions, or other foreign retirement accounts) generally need to be reported in Canada as part of your worldwide income. Foreign tax may be withheld; you may be able to claim a foreign tax credit, but the income is typically still reportable.

Other income sources (often missed)

EI benefits, some support payments (rules depend on the type and arrangement), scholarships/bursaries (may be partially or fully exempt depending on status), and other taxable benefits.

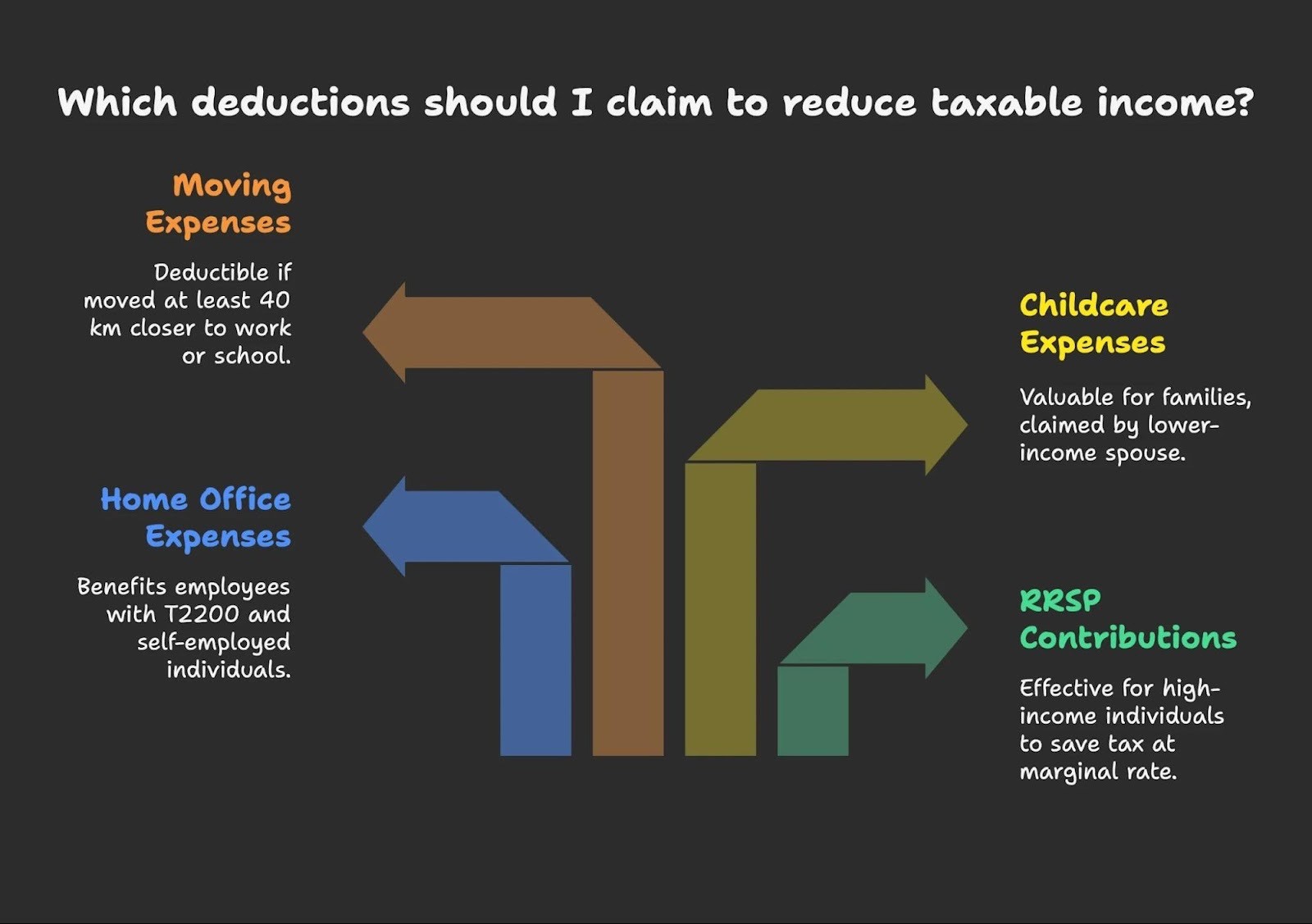

Deductions that reduce taxable income

Deductions reduce the income you’re taxed on.

RRSP contributions

RRSP contributions are generally deductible and can be one of the most effective ways to reduce personal income tax.

How the tax benefit works: the deduction usually saves tax at (or close to) your marginal tax rate, meaning the higher your income bracket, the bigger the tax savings per $1 contributed.

Planning tip: RRSPs can be used strategically to smooth income across years (for example, offsetting a high-income year, self-employment income spikes, bonuses, or taxable capital gains).

2025 tax year RRSP deadline: March 2, 2026.

Home office expenses

Employees typically need a signed T2200 from the employer to claim employment expenses (detailed method). Self-employed individuals can generally claim a reasonable portion of eligible home costs based on business use.

Childcare expenses

Childcare can be one of the most valuable deductions for families. Eligible expenses often include daycare, day camps, before/after-school care, and certain caregiver arrangements (documentation matters).

Who usually claims it: generally the lower-income spouse/partner claims the deduction, with limited exceptions (for example, when the lower-income person is in school, disabled, or otherwise unable to provide care).

Common mistakes: claiming non-eligible activities, missing receipts, or claiming the wrong person. If your situation is complex (shared custody, multiple caregivers, self-employment, or mixed personal/business arrangements), get advice before filing.

Moving expenses

If you moved at least 40 km closer to a new work location, business location, or qualifying school, certain moving costs may be deductible (conditions apply).

Eligible costs commonly include:

Transportation and storage of household items

Temporary lodging and meals (within limits)

Lease cancellation costs

Real estate commissions and legal fees on the sale (and certain costs to acquire a new home)

A key limitation: moving expenses generally can’t create or increase a loss—you typically need eligible income at the new location to absorb the deduction.

Because moving claims are documentation-heavy and often reviewed, it’s worth getting the categories and support right upfront.

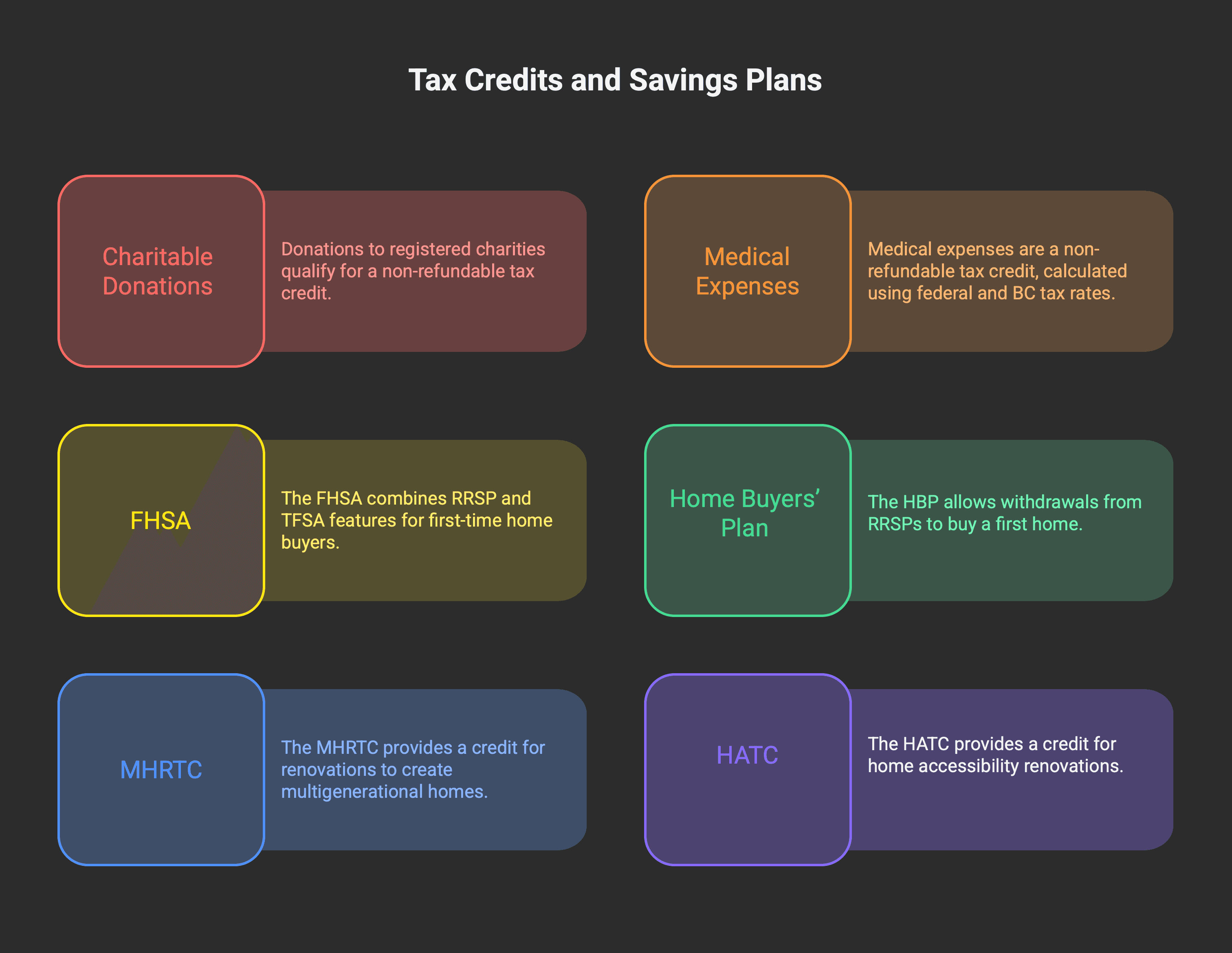

Tax credits and programs that reduce tax payable

Credits reduce tax payable directly (non-refundable credits can reduce tax to zero; refundable credits can create a refund depending on the program).

FHSA (First Home Savings Account)

The FHSA combines features of an RRSP and TFSA: contributions are generally deductible, and qualifying withdrawals to buy a first home are generally tax-free. Annual participation room is typically $8,000, with a lifetime limit.

Home Buyers’ Plan (HBP)

The HBP withdrawal limit is $60,000 (for withdrawals after April 16, 2024). Temporary repayment relief applies for certain first withdrawals from 2022–2025 (repayment start is delayed).

Multigenerational Home Renovation Tax Credit (MHRTC)

If eligible, the MHRTC is 15% of qualifying costs up to $50,000 (maximum $7,500).

Home Accessibility Tax Credit (HATC)

If eligible, the annual expense limit is $20,000.

Filing your 2025 tax return: deadlines and compliance

2025 tax year = income earned in 2025, filed in 2026.

Key deadlines

March 2, 2026: RRSP contribution deadline for the 2025 tax year

April 30, 2026: deadline to file most personal returns and pay any balance owing

June 15, 2026: filing deadline if you or your spouse/common-law partner are self-employed (but any balance owing is still due April 30)

Tax instalments

Tax instalments are advance payments toward your personal income tax bill. They’re most common for self-employed taxpayers, landlords, and investors—anyone who earns income that doesn’t have enough tax withheld at source.

When instalments are usually required You may need to pay instalments if your net tax owing (tax payable minus withholding and credits) is more than $3,000 in the current year and in either of the two prior years. (In Québec, the threshold is lower.) The CRA often sends instalment reminders, but you can still be required to pay even if you don’t receive a reminder.

Typical due dates (most individuals) Instalments are usually due quarterly:

March 15

June 15

September 15

December 15

How much do you pay? Three common options

CRA no-calculation option (instalment reminders): pay the amounts shown on CRA reminders. This approach generally protects you from instalment interest if you pay on time.

Prior-year option: base instalments on your prior year’s tax owing (useful if income is steady).

Current-year option: estimate what you’ll owe for the current year and pay based on that estimate (useful if your income dropped, but riskier if your estimate is low).

Why people get surprised Instalment issues often show up when you:

become self-employed for the first time,

have a large capital gain,

start earning significant investment or rental income,

collect EI or other benefits without enough withholding,

or have multiple income sources where withholding doesn’t keep up.

What happens if you don’t pay enough

If instalments are required and you underpay or pay late, the CRA can charge instalment interest (and in some cases an instalment penalty if the shortfall is large). This is on top of any interest that may apply if you still owe a balance after filing.

Practical ways to avoid problems

Set aside cash from each payment if you’re self-employed.

Consider voluntary instalments even before CRA requires them.

If you also have a T4 job, you can sometimes increase withholding at source to reduce (or eliminate) instalments.

Get a tax estimate mid-year (or quarterly) so you’re not guessing.

If you’re unsure whether instalments apply or how to calculate them, get advice from Modern Axis CPA early—instalment errors can add avoidable interest costs.

Record keeping

Keep receipts and supporting documents for at least six years after filing.

Final thoughts: when a tax accountant is worth it

If your return is simple, tax software may be fine. If you have self-employment income, rentals (especially short-term), investments/crypto, foreign income, or major life changes, a tax accountant can help you file accurately, claim what you’re entitled to, and avoid preventable CRA issues.

Alex Ataman, CPA

Founder

Modern Axis CPA

Disclaimer: This post is general information and does not constitute professional tax advice. Tax outcomes depend on your facts—consult a qualified tax accountant for advice specific to your situation.