Bookkeeping Basics for Small Business Owners: How to Stay Organized and Help Your Accountant

Bookkeeping Essentials for Small Business Owners: A Practical Guide That Actually Helps

Good bookkeeping is not optional if you want a healthy business. It is the foundation of reliable financial reporting, lower accounting fees, fewer CRA problems, and better decision‑making. Poor bookkeeping, on the other hand, almost guarantees higher professional fees, missed deductions, and an increased risk of CRA reviews and reassessments.

Whether you are a sole proprietor, freelancer, or running an incorporated business in Canada, understanding the basics of bookkeeping will save you money and stress. At ModernAxis, we see the same issues come up again and again, and most of them are completely avoidable.

This guide covers practical bookkeeping fundamentals, explains the core account types you will see in your accounting software, and clarifies common problem areas such as expense versus capital spending. It is written for business owners, not accountants.

Why Good Bookkeeping Matters More Than You Think

Bookkeeping is not just about compliance. It affects:

How much you pay in tax

How quickly your accountant can work (and bill)

Whether CRA questions your return

How confident you feel making business decisions

Your ability to get financing or investors

CRA reviews almost always start with sloppy records. Missing receipts, mixed personal and business transactions, and unexplained balances are red flags. Clean books reduce that risk significantly.

Good bookkeeping also gives you clarity. If you do not trust your numbers, you cannot manage your business properly.

Keep Personal and Business Finances Separate

This is the single most important bookkeeping habit.

Every business should have:

A dedicated business bank account

A dedicated business credit card

Mixing personal and business transactions creates confusion, increases accounting time, and raises audit risk. CRA expects a clear separation, especially for incorporated businesses.

Common mistakes we see:

Paying personal groceries from the business account

Using personal credit cards for business expenses without tracking them

Transferring money randomly without documentation

If you accidentally pay a personal expense from the business, it must be recorded correctly, usually through a shareholder loan or owner’s draw account. Ignoring it creates tax problems later.

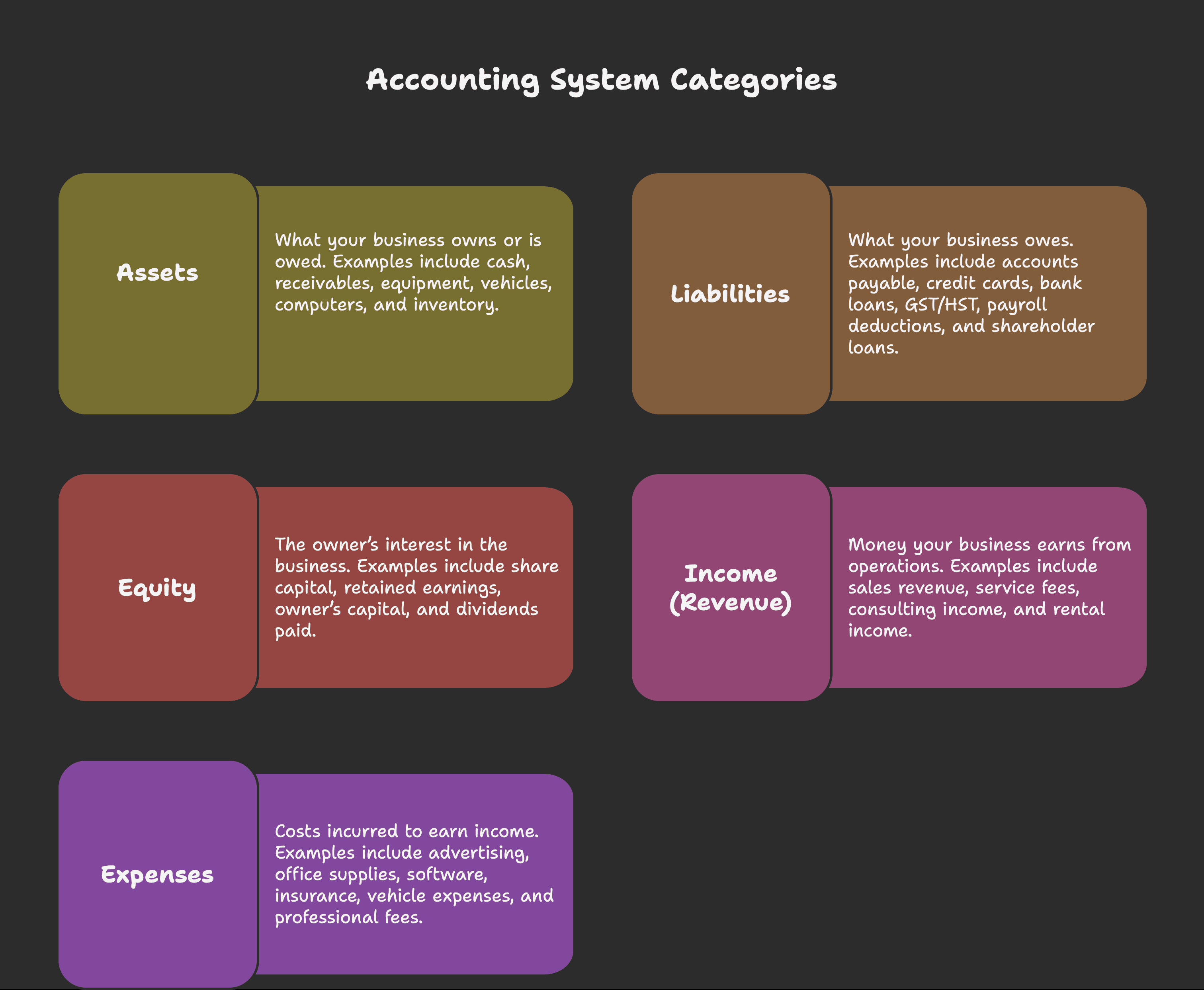

Understanding the Five Core Account Types

Every accounting system is built around five main account categories. Understanding these will dramatically improve how you read your financial statements and how accurately transactions are recorded.

Assets

Assets are what your business owns or is owed.

Examples include:

Cash in the bank

Accounts receivable (money customers owe you)

Equipment and tools

Vehicles

Computers and office furniture

Inventory

Assets appear on the balance sheet. Some assets are short‑term (cash, receivables), while others are long‑term (equipment, vehicles, buildings).

Liabilities

Liabilities are what your business owes.

Examples include:

Accounts payable (unpaid bills)

Credit cards

Bank loans

GST/HST or PST payable

Payroll source deductions

Shareholder loan balances (if applicable)

Liabilities also appear on the balance sheet. Ignoring liabilities is one of the fastest ways to get into trouble with CRA.

Equity

Equity represents the owner’s interest in the business.

Examples include:

Share capital (for corporations)

Retained earnings

Owner’s capital (for sole proprietors)

Dividends paid

Equity changes based on profits, losses, contributions, and withdrawals.

Income (Revenue)

Income is the money your business earns from its operations.

Examples include:

Sales revenue

Service fees

Consulting income

Rental income

Income is reported on the income statement and is generally taxable unless a specific exemption applies.

Expenses

Expenses are the costs incurred to earn income.

Examples include:

Advertising

Office supplies

Software subscriptions

Insurance

Vehicle expenses

Professional fees

Expenses reduce taxable income, but only if they are properly classified and supported.

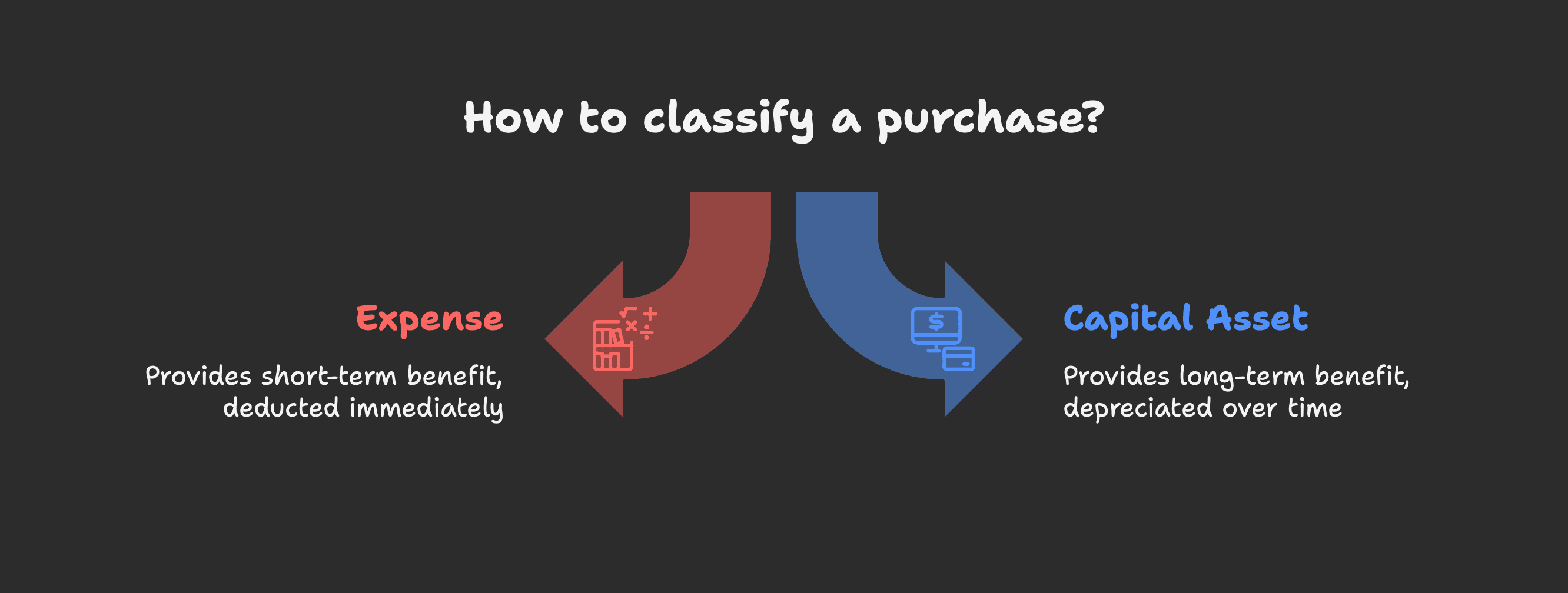

Expense vs Capital: A Critical Distinction

One of the most common bookkeeping errors is misclassifying capital purchases as expenses.

What Is an Expense?

An expense is a cost that provides a short‑term benefit, usually within the year.

Examples:

Office supplies

Repairs and maintenance

Advertising

Software subscriptions

Meals (50% deductible in most cases)

Expenses are deducted immediately against income.

What Is a Capital Asset?

A capital asset provides a long‑term benefit and must be depreciated over time.

Examples:

Computers

Vehicles

Machinery and tools

Furniture

Leasehold improvements

Capital assets are recorded on the balance sheet and expensed gradually through capital cost allowance (CCA).

Why This Matters

Expensing capital items incorrectly can:

Overstate deductions

Trigger CRA adjustments

Result in penalties and interest

CRA looks closely at this area. When in doubt, ask before filing.

Understanding the Shareholder Loan Account

For incorporated businesses, the shareholder loan account tracks money moving between you and the corporation that is not salary or dividends.

Common situations:

You pay a business expense personally

You take cash from the corporation

You lend money to the company

If you owe the corporation money at year‑end, CRA may treat it as taxable income if not dealt with properly. This is a frequent issue in CRA audits.

Clean tracking throughout the year makes year‑end planning much easier.

Sales Tax: GST, HST, and PST Basics

If you are registered for GST/HST or PST, bookkeeping accuracy is critical.

Key points:

Charge tax correctly on taxable sales

Track tax collected separately from income

Claim input tax credits only on eligible expenses

Keep receipts that clearly show tax

Common mistakes include claiming ITCs without proper documentation or charging tax incorrectly. Both can lead to reassessments.

We can help determine registration requirements and filing frequency, but accurate tracking during the year is essential.

Receipts and Cloud Accounting Software

CRA accepts digital receipts, provided they are readable and properly stored.

Using cloud accounting software such as QuickBooks Online or Xero allows:

Automatic bank feeds

Real‑time financial reporting

Easier collaboration with your accountant

Cleaner audit trails

Scanning receipts as you go eliminates year‑end chaos and reduces professional fees.

Bank and Credit Card Reconciliations

Reconciling means matching your bookkeeping records to bank and credit card statements.

Why this matters:

Identifies missing or duplicated transactions

Detects errors early

Ensures cash balances are accurate

Monthly reconciliation is the minimum standard for a healthy bookkeeping system.

Paying Yourself the Right Way

How you pay yourself affects both tax and bookkeeping accuracy.

For incorporated businesses, this usually involves:

Salary

Dividends

A combination of both

For sole proprietors, profits are taxed personally regardless of withdrawals, but tracking draws is still important.

Incorrect withdrawals are a common source of tax issues.

Talk to Your Accountant Before It Becomes a Problem

The most expensive bookkeeping mistakes are usually made quietly throughout the year and discovered too late.

If you are unsure about:

Recording a transaction

Buying equipment

Registering for sales tax

Paying yourself

Ask early. Fixing issues mid‑year is far cheaper than fixing them after filing.

Final Thoughts: Clean Books Create Better Businesses

Good bookkeeping is not about perfection. It is about consistency, clarity, and documentation.

Clean books:

Reduce tax risk

Lower accounting fees

Improve decision‑making

Make CRA interactions far less stressful

If you want help setting up or cleaning up your bookkeeping, ModernAxis can help you build a system that works year‑round, not just at tax time.

Alex Ataman, CPA

Founder

Modern Axis CPA

Disclaimer: This article is for general information only and does not constitute professional accounting or tax advice.